Identifying and Avoiding Phone Scams

Every year, people report fraud, identity theft and bad business practices to the Federal Trade Commission (FTC) and law enforcement partners. According to FTC data, nearly

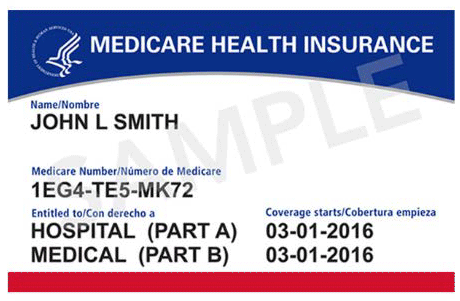

Medicare Supplement Insurance is a type of private health insurance that helps cover certain Medicare out-of-pocket costs such as copayments, deductibles and coinsurance. Over 13 million Americans are estimated to currently have their own Medicare Supplement Insurance plan.

Identifying and Avoiding Phone Scams

Every year, people report fraud, identity theft and bad business practices to the Federal Trade Commission (FTC) and law enforcement partners. According to FTC data, nearly